Nothing to Fear but Fear Itself

Fear is an incredibly powerful emotion that can have a significant impact on our lives; that is if we allow it to do so. I’ve experienced fear on more than a few occasions while hiking in the Canadian Rockies near a ledge, or on a peak, while thunder and lightning boomed overhead. I also felt tremendous fear when I was robbed at gunpoint, not once, but twice in the same day during a business trip to Brazil.

While fear can seem overwhelming, it is the reactions we have to fear that can cause the most damage. This holds especially true with investing. Many investors have reacted to fear-inducing events in the market in ways that have negatively impacted their long-term goals. However, with proper planning and perspective we can avoid the actions that would be detrimental to our financial goals.

Below are just a few examples of investing fears and the actions we can take to mitigate them:

Fear of Markets - Throughout the history of the stock market there have been periods where many have believed that the “market” was extremely overvalued. A number of times, these contrarians were proven correct (i.e. Dot Com disaster in the early 2000s, or the 2008 Market Crash). While they may have been correct regarding the valuations, no one could accurately predict exactly when the expected correction would occur. Two of the most famous investors in the world, Warren Buffett and Jack Bogle (founder of Vanguard), have said they have never met anyone that could correctly time the markets. The reason is pretty simple: no one can predict the future.

During such times, too many investors take actions that are detrimental to their long-term goals; in fact they try to time the market and sell. Take a look at the rates of returns compiled by JP Morgan* in the image below. Notice what the average investor’s rate of return (in orange) is versus other asset categories. The reason is because the average investor succumbs to fear and makes investment decisions (selling) that reduce their investment returns.

Ironically, there are times when people sell in hopes to avoid losses, and instead miss out on some of the largest gains. The Covid-19 correction is a great example. Those that sold in March or April missed out on an absolutely stunning rally that continues today.

For further evidence here is some data from Bank of America:

Looking at data going back to 1930, Bank of America found that if an investor missed the S&P 500’s 10 best days in each decade, (Note: that’s just 10 trading days out of over 2,530 each decade), that total returns would be just 91% vs. 14,962% return for investors who stayed invested during the downturns. Put another way, they missed just 90 of the best days out of approximately 22,770 in the past 90 years. While missing only 0.39% of the days, their returns were an astonishing 99.4% lower! Why? Because when people sell they miss out on the best days which generally follow the worst days for stocks.**

Actions — What’s a person to do? Have a sound investment strategy and financial plan that allows you to stay invested. I’ve shared my own personal experience of a time when I succumbed to fear and sold a stock, and as a result missed out on a subsequent 11,000% rally. Ouch! See my blog entitled Stay Invested for the sad details. Of course staying invested is easier said than done which is why a Certified Financial Planner (CFP ®) can be beneficial in helping you stay the course.

Fear of Missing Out — Another dangerous fear when it comes to investing is the fear of missing out, or “FOMO”. This fear has caused many an investor to behave irrationally. Take the recent Gamestop rollercoaster ride from a few months back where many investors bought the stock merely because others were, hoping to not miss out on these incredible gains.

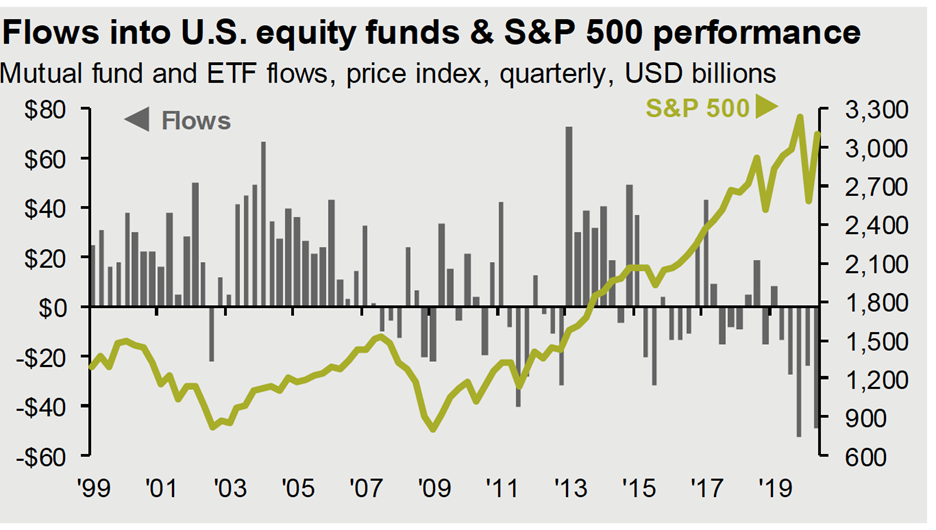

For more, look at the nearby table (also from JP Morgan*), that shows the flows of money in and out of the market overlaid with the returns of the S&P500 since 1999. As you will notice, the money flows in near the peaks and out near the troughs. These investors are essentially buying high and selling low.

Actions - The best actions to take to mitigate against this fear is to ignore the noise and stick to a periodic investment strategy. Many are already doing so via contributions to the 401k. See my previous blog entitled The Best Time to Invest.

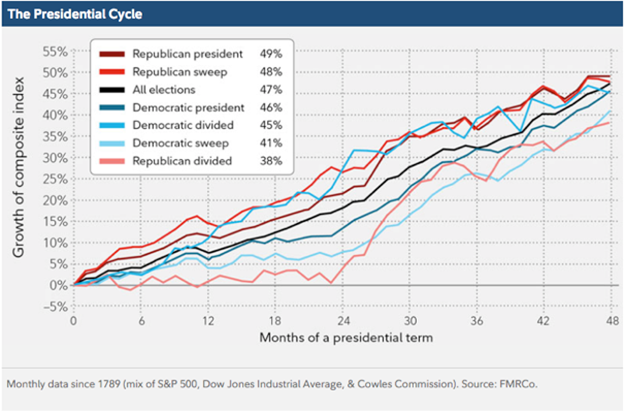

Fear of Elections — Many investors panic when one party or the other wins the election and predict dire warnings of the impact on the markets. But the evidence overwhelmingly shows that who occupies the White House, the House, or Senate, does not materially impact the markets. The stock market since 1789 has continued to rise regardless of which party is in power and regardless of the makeup of congress. Just look at the chart below.***

Actions — What’s a person to do? Surprise, the correct answer is to stay invested in a well-diversified portfolio that is appropriate for your goals and tolerance for risk. If you are not sure if your investments meet those criteria, a CFP® can be of benefit. See my previous blog entitled Most Accidents Happen on the Way Down that outlines why it’s important to have the correct strategy in place, and why it’s so dangerous when you don’t.

While I was in the mountains, my fears came about most times as a result of poor decisions I had made (not understanding the trail or not checking the weather). Being robbed in Brazil however was merely a fluke of being in the wrong place at the wrong time. Some events can be prepared for such as reading maps, checking the weather, or creating a sound investment and financial plan. Other events cannot be prepared for, like being robbed at gunpoint or a falling stock market. But with investing, the strategy is to have a comprehensive investment and financial plan and stick to it.

Succinctly put, FDR was right, the only thing to actually fear is fear itself. If you are prepared with a great financial plan, you should not fear.

Thank you for taking the time to read my blog. I hope you found it helpful. If you have any questions regarding your own financial plans, feel free to schedule a no cost, no obligation introductory meeting. Further information regarding this introductory meeting can be found here.

Resources:

**- https://www.cnbc.com/2020/03/07/when-you-sell-during-a-panic-you-may-miss-the-markets-best-days.html